India’s digital consent revolution just crossed a critical milestone. The Telecom Regulatory Authority of India (Trai), in partnership with the Reserve Bank of India, has successfully completed a pilot that could fundamentally reshape how brands communicate with customers—and it’s about far more than stopping spam. With a nationwide rollout expected to begin with banks in early 2025, this represents the most significant shift in marketing infrastructure since the introduction of GDPR in Europe.

What Just Happened: The Blockchain-Powered Consent Revolution

The Digital Consent Acquisition (DCA) pilot, which concluded in late December 2025, involved nine telecom service providers and eleven major banks including SBI, HDFC Bank, ICICI Bank, Axis Bank, and Kotak Mahindra Bank. For the first time, customers received SMS notifications from the common short code 127000, giving them a transparent, digital interface to review, manage, and revoke consents they’d given—including those “legacy consents” buried in paper forms signed years ago.

But here’s the breakthrough that changes everything: instead of requiring brands to recollect fresh consent from millions of customers—which officials acknowledged would be “logistically impossible”—Trai has deployed a distributed ledger based on blockchain technology. Banks upload their legacy consents to this tamper-proof registry, taking full responsibility for the validity and verification of what they’re uploading. This creates an unprecedented layer of accountability that didn’t exist in the old regime.

The challenge this pilot addressed was deceptively simple yet profound: while Trai’s 2018 regulations required prior consent for commercial communications, they never mandated that historical consents be migrated to a digital registry or provided customers with tools to view and revoke them. This created an asymmetry where customers could block new solicitations but couldn’t see or retract old ones—leaving vast silos of unverifiable, offline consents that brands continued to exploit.

Why Brands Should Be Paying Attention

The End of Consent Opacity

The pilot introduces a Consent Registration Function (CRF)—a unified, interoperable digital registry maintained by telecom providers that enables real-time verification of consent before any commercial communication is initiated. Banks participating in the pilot had to upload consent records to this shared platform, which then interfaced with TSPs’ messaging engines to enforce customer preferences instantaneously.

For brands, this means the days of relying on dusty databases and unverifiable “offline consents” are numbered. When this scales nationally—which Trai officials have confirmed will start with banks and then expand to all commercial entities—every promotional message will need to be traceable to an informed, revocable, time-stamped digital consent.

Infrastructure Investment Is Non-Negotiable

Trai has established four working groups comprising representatives from telcos, banks, and industry associations that meet weekly to address implementation challenges. The findings are sobering: telecom providers will need substantial server infrastructure to manage “hundreds of millions of consents,” while banks discovered that many don’t even have centralized consent records across their regional offices and business units.

Some banks participating in the pilot had to completely reorganize their internal processes and create centralized repositories from scratch just to participate. For retail brands, BFSI players, e-commerce platforms, real estate companies, trading firms, and anyone doing performance marketing at scale, this signals a fundamental shift in martech infrastructure requirements.

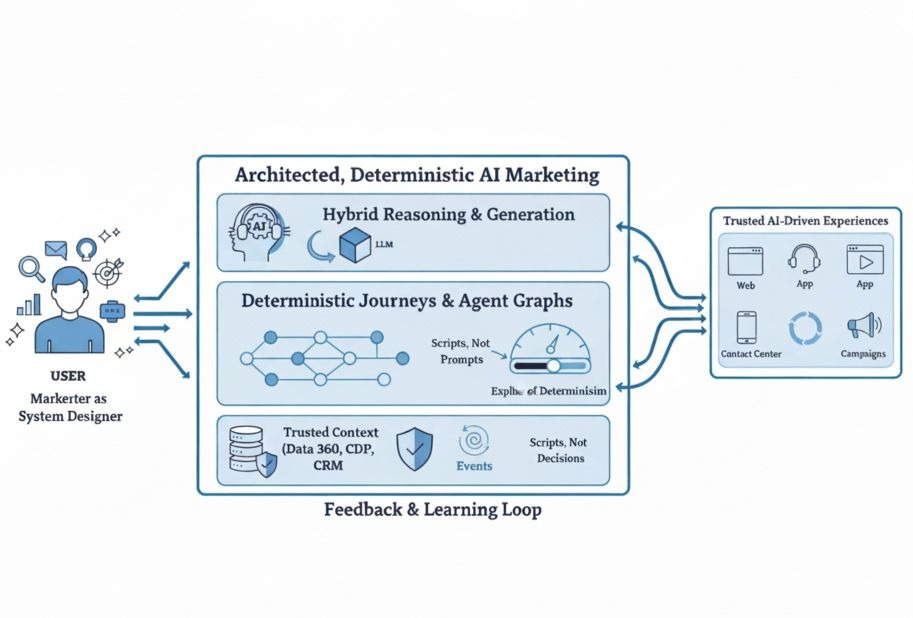

Your CRM and marketing automation platforms will need native integration with the CRF framework, and your data governance practices must evolve to maintain consent audit trails that meet regulatory standards. More critically, you’ll need to take responsibility for the validity of every consent you upload—a liability shift that many brands are unprepared for.

Consumer Control Becomes Real—and Immediate

The pilot’s multi-modal architecture—web portals accessed via secure links, mobile apps, and SMS interfaces—recognizes that consumer choice must accommodate varied digital literacy levels. Customers receive fortnightly communications detailing recorded consents and revocation procedures, transforming consent from a passive, one-time checkbox into an active, ongoing relationship.

Critically, no personal or financial information is sought at any stage, and all actions are optional—this is purely about transparency and control. Through authorized consent management pages hosted by their telcos, customers can view which consents have been recorded against their mobile numbers by participating banks and decide whether to continue, modify, or revoke them.

This has profound implications for customer experience strategy. Brands that have relied on inertia and friction to maintain their communication privileges will face immediate opt-out rates when customers gain transparent, convenient control. Meanwhile, brands that have built genuine value in their customer communications—personalized, relevant, timely—will likely see consent retention strengthen their competitive moat.

The DPDP Act Convergence: India’s Consent Manager Vision

The timing is no coincidence. The pilot dovetails with India’s Digital Personal Data Protection Act (DPDPA) 2023 and the newly released DPDP Rules 2025, which introduce one of the world’s most ambitious privacy innovations: statutory Consent Managers.

A Global First in Privacy Architecture

Unlike GDPR, which relies entirely on controllers and processors to manage consent, or California’s CPRA, which creates opt-out signals but not consent intermediaries, India has conceptualized a federated, interoperable consent ecosystem where users centralize, monitor, modify, and withdraw consent through trusted, neutral intermediaries.

Consent Managers (CMs) are regulated entities—similar in regulatory rigor to Account Aggregators in fintech—that must be incorporated in India and demonstrate adequate financial stability, technological capability, robust data security practices, operational resilience, accountability mechanisms, and grievance redressal frameworks. They cannot monetize user data, engage in targeted advertising, or process personal data for secondary purposes—their function is strictly limited to consent management.

This aligns with India’s broader digital public infrastructure (DPI) model, seen in Aadhaar, UPI, DigiLocker, Account Aggregators, and ONDC, where interoperable, consent-driven systems transform markets. The Trai pilot is effectively testing the operational blueprint for this broader consent infrastructure.

What This Means for Brands

The DPDP Rules mandate that consent must be free, specific, informed, unconditional, and unambiguous—expressed through affirmative action and always revocable. Consent Managers will provide unified dashboards for managing user consents across platforms, ensure interoperability via standard APIs, maintain records for audit and compliance, and propagate consent withdrawals across services seamlessly.

For brands, this means your consent infrastructure can’t be siloed within your martech stack—it must integrate with broader privacy management architecture, encompassing data sharing practices with third-party agencies, attribution partners, programmatic platforms, and analytics providers. Consent Manager integrations may become requirements in enterprise RFPs, particularly for SaaS and B2B companies.

Strategic Imperatives for Brands

Audit Your Consent Inventory Now

Before the national rollout, conduct a comprehensive audit of every consent you hold. Which were obtained digitally versus offline? Can you prove they were informed and specific? Do you have centralized records, or are consents scattered across regional offices, call center databases, partner systems, and third-party lead aggregators? Banks that delayed this exercise found themselves scrambling during pilot onboarding.

Remember: when you upload consents to the blockchain-based distributed ledger, you’re taking legal responsibility for their validity and verification. This isn’t a compliance checkbox—it’s a liability assumption that could expose brands with poor consent hygiene to regulatory action and reputational damage.

Rethink Your Acquisition Economics

If obtaining valid, verifiable consent becomes significantly more friction-laden, the unit economics of customer acquisition will shift. Performance marketing strategies predicated on purchased lists, third-party lead aggregators, and cookie-based consent will face structural headwinds.

The ad-tech and marketing ecosystem will see disruption across third-party cookie-based consent, profiling-based ad consent, and behavioral tracking systems as consent withdrawal becomes faster and consent review becomes more transparent. Brands should model scenarios where consent acquisition costs rise by 3-5x and optimize for first-party data strategies, owned-channel growth, and value-exchange models that incentivize genuine opt-in.

Invest in Consent as Customer Experience

The brands that will thrive are those that reframe consent management not as compliance overhead but as a trust-building customer experience. Transparent preference centers, granular control over communication frequency and topics, multi-lingual UX that complies with Rule 3 of the DPDP Rules, and demonstrable respect for revocation requests can become differentiators in crowded categories.

When customers see your brand treating their consent as a privilege rather than a right, loyalty follows. Industry experts note that while stricter consent rules may initially feel constraining, “transparent consent systems create long-term brand equity” and can become competitive advantages in markets where trust is eroding.

Build for Interoperability and Portability

The CRF framework mandates interoperable systems between Originating Access Providers and Terminating Access Providers, with access controls, audit logging, and performance safeguards. Your martech stack must be architected for consent data portability—able to ingest consent states from the national registry and statutory Consent Managers, propagate preferences across campaign execution systems in real time, and generate audit trails for Data Protection Board inspection.

Platform consent flows should be modular and integration-friendly, with APIs that align with government standards and schemas. Consent given on Consent Manager A must be readable and actionable by Platform B—fragmentation will not be tolerated in this ecosystem.

Prepare for 18-Month Transformation Window

Legal experts warn that 18 months—the likely implementation timeline for full DPDP compliance—is short given the technical changes involved. Companies should begin integration planning immediately, conduct comprehensive data-mapping exercises to identify all data processed, shared, and transferred, redesign consent UX to be clear and simple, train compliance and product teams on CM workflows and regulatory requirements, update vendor agreements to reflect CM-based consent as authoritative, and prepare documentation for Data Protection Board oversight.

The Bigger Picture: India’s Consent Infrastructure as Global Model

If this pilot succeeds at scale, India will have constructed one of the world’s most sophisticated consent-driven digital commerce infrastructures. While GDPR created high consent standards, it didn’t solve consent fatigue, information asymmetry, or fragmented consent workflows. India’s approach—combining blockchain-based distributed ledgers, statutory consent intermediaries, interoperable APIs, and digital public infrastructure principles—offers a blueprint that could influence global privacy regulation, especially in regions facing similar scale and diversity challenges.

For brand marketers and customer experience leaders, this isn’t a threat—it’s an opportunity to rebuild customer relationships on a foundation of transparency, control, and genuine value exchange. The brands that move first, invest deeply, and embrace consent as a strategic asset rather than a regulatory burden will define the next decade of customer engagement in India’s digital economy.

As one privacy expert noted, “Early adopters will not only achieve compliance but will gain trust, competitive advantage, and alignment with India’s rapidly evolving digital ecosystem”. In a world where customer trust is the scarcest resource, that advantage could prove insurmountable.