Providing easy access to finance first requires bringing the population into the country’s formal financial system. We all know that entrepreneurship, investment and economic growth suffer when a parallel system with middlemen operates outside the formal financial system. There are traditionally significant barriers to financial inclusion – from societal attitudes to legal issues to very high transaction costs. I know the truth is, as always, somewhere in between. And that’s why sustaining mega projects like the Jan Dhan Yojana where more than a record 36 crore accounts were opened to implement and drive this massive change towards financial inclusion are difficult. I am happy to note that currently more than Rs. 1 lakh crore sits in these Jan Dhan accounts and it shows how habits can be influenced if there is a institutional desire. Some of the other initiatives like moving to digital payments and reducing the flow of cash in the economy will take some time to happen, but we are certainly taking baby steps in that direction, which will potentially become huge strides in the years to come. In any case this huge initiative, conducted in mission mode, has demonstrated that – digital financial infrastructure can be designed and implemented so that the large gaps in financial inclusion can be narrowed down between genders, as well as between income levels, education and degrees of urbanisation. In my opinion this is the largest change management project undertaken in the history of mankind.

I was just going through the report released by BIS on the design of digital financial infrastructure in India. It makes many interesting observations:

- India’s approach rests on the principle of providing digital financial infrastructure as a public good.

- The provision of national digital biometric identity – Aadhaar, to all residents has effectively granted them access to the banking system.

- The development of a real-time payment system platform has brought efficiencies to retail customers and small-scale transactions by providing cheap and instantaneous payment services to ordinary citizens.

- The establishment of a legal framework for data fiduciaries promises to ensure that individuals can readily access the data generated by their online activity and dictate the circumstances for sharing that data.

- India’s digital infrastructure is designed to support both public and private sector innovators, including big tech companies, to create products that operate within the regulatory framework. Therefore, a big tech firm and a traditional commercial bank can both operate on the same digital platform. Further, these platforms, when built and operated by public institutions, provide regulators with the means to ensure that financial stability concerns are adequately addressed.

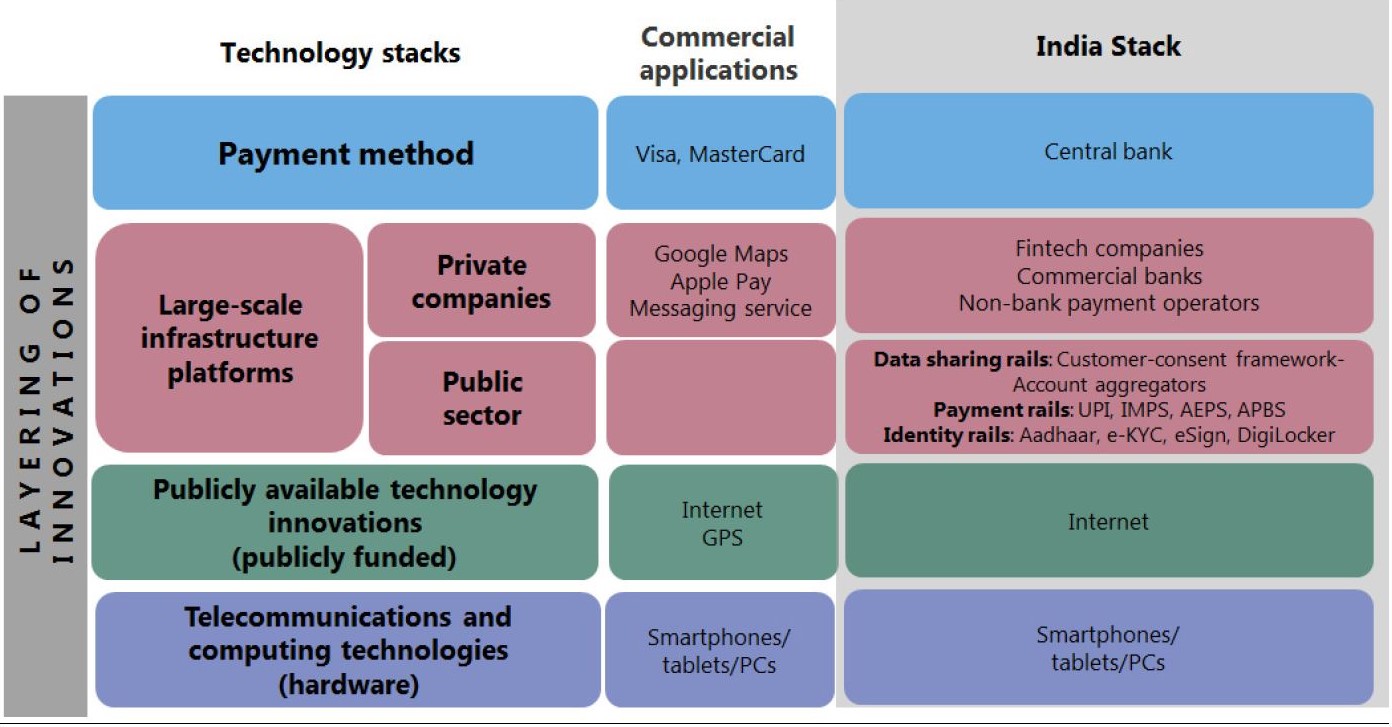

Do have a look at the India technology stack, which outlines India’s unique approach to building financial infrastructure:

India’s digital foundational infrastructure is based on two principles – building digital platforms as public goods so both public and private sector participants are able to develop technological innovations and incorporating data privacy and security in the design of digital public goods. India offers a big case study and insights into how the Central bank (RBI) and the Commercial banks can together run a payment system that operates successfully and is also open to participation from boutique FinTech’s to Big Techs and provides all the network benefits that big tech systems usually provide, but settles instantly in fiat money inside the central bank.

If you are interested in more details do have a look at the attached report. [pdf-embedder url=”https://cxmlab.com/media-bucket/2019/12/bispap106-1.pdf”]